FREE SHIPPING ON

ALL QUALIFYING ORDERS

Enter your email below to join our mailing list:

Before we know it, the New Year will be upon us!

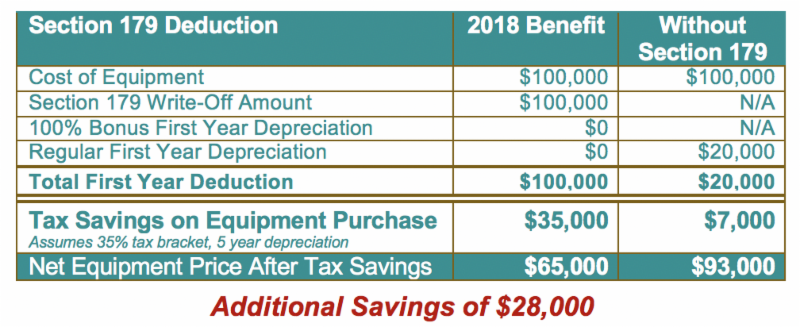

Don’t miss out on important tax savings for 2018: IRS Section 179 enables businesses who acquire equipment to write-off up to $1,000,000 per year. The amount you save in taxes can actually exceed the payments you make during this taxable year.

See below for an example of what Section 179 can do for your financing project.Contact your tax advisor for specific impact to your business. Be sure to contact Trowel Trades for your equipment financing needs!

For example you could buy two (2) Hydro Mobile M-SERIES mast climbing work platforms and thirty two (32) M & P series towers from Trowel Trades for about $100,000 and save up to $28,000 in 2018 tax benefit for your company.

The election, which is made on Form 4562, is for the tax year the property was placed in service or an amended return filed within the time prescribed by law. The total cost of property that may be expensed for any tax year cannot exceed the total amount of taxable income during the tax year. Section 179 property is property acquired for use in the active conduct of your business. To ensure property qualifies, reference Publication 946.

No spam, notifications only about products and updates.

Having dealt with MK Diamond Products and the Delahauts since the mid 1990’s it is sad to hear the news that they have closed their

I’ve told my wife and daughter to never follow a mortar mixer down the interstate. For over 30 years we have sold, rented, and repaired

This question is one of the most frequent mixer related questions our rental staff are asked. Our contractor customers know the importance of using the right tools for the job.

Trowel Trades, a company that specializes in equipment rental, tool retail, repair services, scaffolding and mast climber access solutions, enters the Silver Tier of the Masonry Alliance Program.

Your email was submitted successfully.

YOUR 10% OFF COUPON CODE IS WELCOME10.

See category exclusions below.

Category Exclusions:

Arbortech Brick and Mortar Saw, Compaction, Concrete Mixers, Concrete Walk Behind Saws, Drop Hammers, Grout Hogs, iQ Power Tools, Masonry Block Saws, Masonry Brick Saws, Mast Climbers, Mortar Mixers, Mud Buggy, Saws, Scaffold, Self Dumping Hoppers, Shoring, and Stihl