FREE SHIPPING ON

ALL QUALIFYING ORDERS

Enter your email below to join our mailing list:

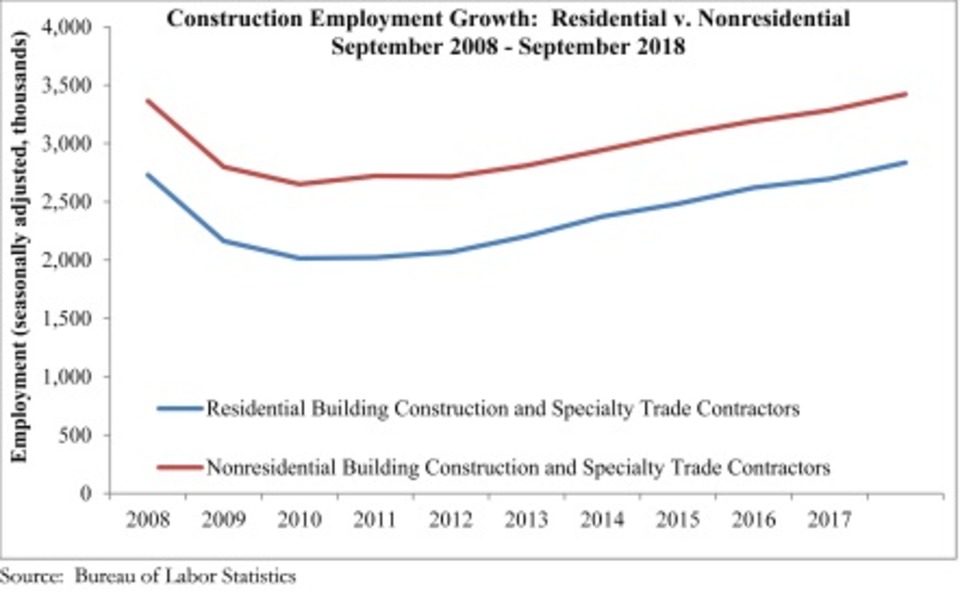

Nonresidential construction employment expanded by 18,600 net jobs on a monthly basis, while the residential sector added just 4,400 net positions

The U.S. construction industry added 23,000 net new positions in September, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics data.

During the last 12 months, the industry has added 315,000 net new jobs, an increase of 4.5%. Nonresidential construction employment expanded by 18,600 net jobs on a monthly basis, while the residential sector added just 4,400 net positions.

Though construction unemployment rose to 4.1% in September, it remains low by historical standards. National unemployment dropped to 3.7% across all industries, the lowest rate since December 1969.

“For several years, job growth has been just right — not too hot, not too cold,” said ABC Chief Economist Anirban Basu. “The term ‘Goldilocks economy’ is often tossed around, with the implication being that employment growth has been solid enough to keep consumers spending and businesses confident, but not so fast that inflation and interest rates spike, causing asset prices (e.g., stocks, bonds and real estate) to fall in value.

“Coming into the latest employment report, economists were collectively expecting around 180,000 jobs to be created in September and an official rate of unemployment of 3.8%. That’s effectively what occurred,” said Basu. “But these are not the important numbers. The most important number is average hourly earnings growth, which has been at the high point of the cycle recently. Conventional wisdom suggests that if average hourly earnings were to grow 3% or better on a year-over-year basis, that actually would be bad news from the perspective of financial markets. This suggests that the grinding search for talent is driving up compensation costs and that interest rates will continue to head higher.

ASSOCIATED BUILDERS AND CONTRACTORS

ASSOCIATED BUILDERS AND CONTRACTORS

“Contractors will have noticed that borrowing costs have risen more rapidly of late, resulting in yesterday’s sharp dip in stock prices,” said Basu. “Essentially, we may have reached the point in the cycle during which good news is bad news, at least from the perspective of financial market performance. What’s more, construction firms will find it increasingly difficult to recruit labor — that much is obvious. This week’s announcement by Amazon regarding its increase in minimum wages indicates that firms are having to pay more to attract and retain workers. It is perfectly conceivable that more junior members of the construction workforce also heard about Amazon’s new $15 minimum wage.”

No spam, notifications only about products and updates.

Having dealt with MK Diamond Products and the Delahauts since the mid 1990’s it is sad to hear the news that they have closed their

I’ve told my wife and daughter to never follow a mortar mixer down the interstate. For over 30 years we have sold, rented, and repaired

This question is one of the most frequent mixer related questions our rental staff are asked. Our contractor customers know the importance of using the right tools for the job.

Trowel Trades, a company that specializes in equipment rental, tool retail, repair services, scaffolding and mast climber access solutions, enters the Silver Tier of the Masonry Alliance Program.

Your email was submitted successfully.

YOUR 10% OFF COUPON CODE IS WELCOME10.

See category exclusions below.

Category Exclusions:

Arbortech Brick and Mortar Saw, Compaction, Concrete Mixers, Concrete Walk Behind Saws, Drop Hammers, Grout Hogs, iQ Power Tools, Masonry Block Saws, Masonry Brick Saws, Mast Climbers, Mortar Mixers, Mud Buggy, Saws, Scaffold, Self Dumping Hoppers, Shoring, and Stihl